The global pandemic accelerated a push for insurance companies to improve customer experience across all channels and provide a holistic, more personalized content experience.

Already accelerating prior to the pandemic, there is consumer demand for new products and services easily accessible on improved digital channels. In order to grow and retain policyholders and expand their user base, insurance companies need to improve underlying infrastructure, as well as change processes, internal culture, and ensure trusted data is leveraged to support this initiative.

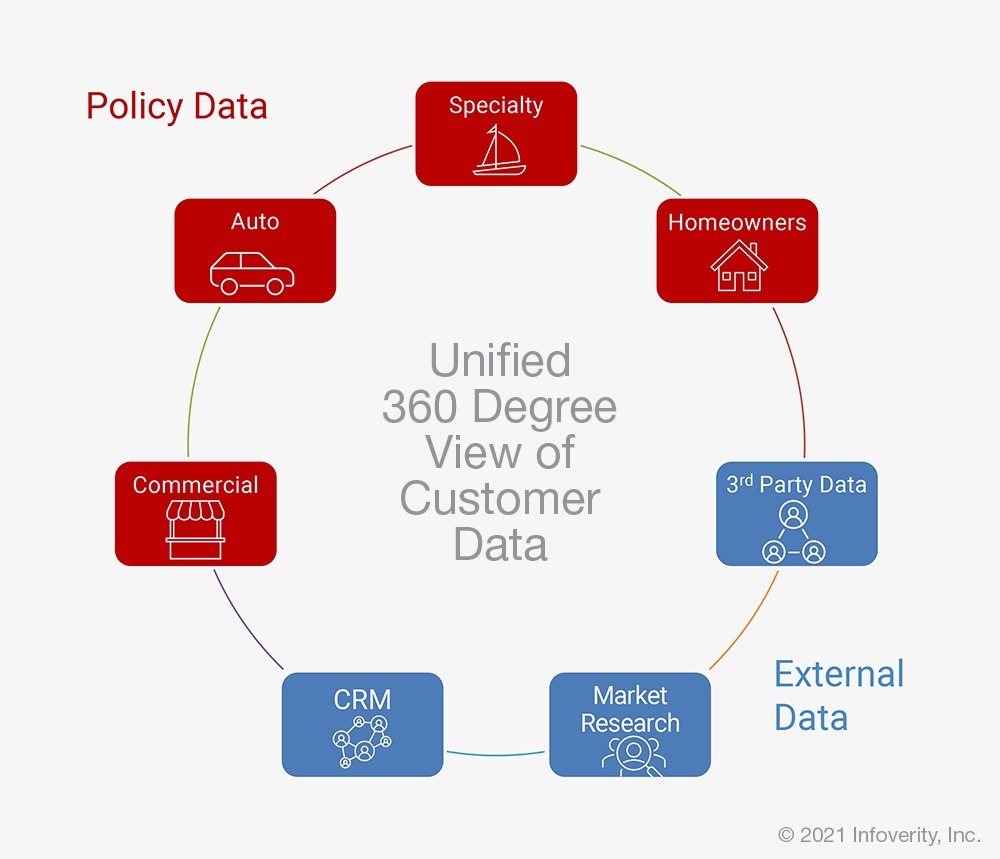

A unified, consistent view of Customer information across channels and lines of business is the first step in enhancing the customer experience. The ability to have this single view of a customer will enable customer service to have information at their fingertips to improve customer experience, which will in turn drive adoption and renewal retention. Although most statistics show that customers don’t renew due to cost, there is a crucial link to customer experience. Customers who understand their coverages, have good experiences across channels, and feel they have the right products, generally continue renewing their policies.

Insurance Companies have been encountering these challenges for many years. What has been stopping them from moving forward?

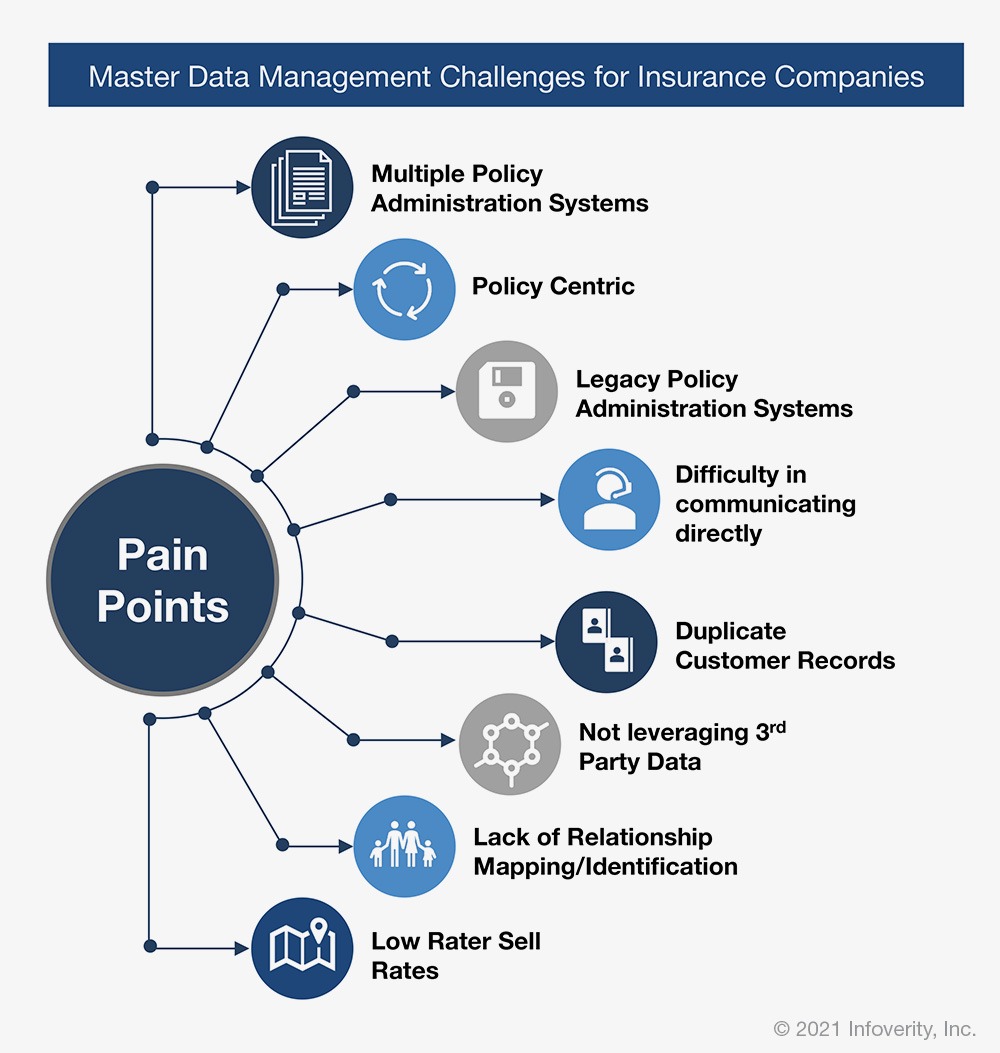

Mainly it’s due to legacy systems and processes and in general being slow to adopt changes. Acquisitions and differentiated lines of business have created processes that vary by channel, with each channel on their own technology foundation and little integration or sharing of data. Legacy Policy Administration Systems (PAS) were built to define the asset being insured, with little thought to capturing important information about the customer who purchased the policy. This created company cultures where processes and technology were developed as policy-centric, not customer centric.

Gartner’s research “…has found that most insurance omni-channel capabilities are immature and lacking due to redundant legacy systems and lack of mid-office capabilities and power channels…”

Source: Gartner – Insurers Must Implement Dynamic Customer Engagement to Solve the Customer Experience Dilemma. Published 3 November 2020 by analyst Kimberly Harris-Ferrante

So, what can a company do to drive Customer Experience and Insights?

Don’t jump immediately into an implementation until first understanding your short and long term view of customer data. A proven Master Data Management (MDM) strategy for the insurance industry could be as simple as performing some data profiling or as extensive as a full customer data strategy and roadmap across all lines of business to understand where and how customer data is authored, edited and stored throughout the company.

- Perform data profiling to understand the state of the data. Where is the quality of data the best/worst? What can be improved? Can we modify the systems where data is authored to perform better edit checks upfront or can we cleanse the data after it’s entered? One of the easiest ways to implement data quality is to implement a tool to perform address standardization and validation. Addresses are key components of customer data.

- Identify customer data pain points and critical use cases. Interview key stakeholders and identify the biggest problem areas and the cost of these pain points. This will help determine prioritization for the biggest business benefit in the shortest period of time.

- Determine where your company stands on the maturity model for customer data. Where are you now and where do you want to go?

- Develop a tactical and strategic roadmap that starts with a foundation to relieve the worst pain points and builds towards longer term initiatives.

Once there is a full understanding of where you want to be in two to three years, create a plan to build the foundation. This foundation should relieve critical pain points in three to five months. One of the main reasons for failure of customer data initiatives is the business sponsors don’t realize benefits fast enough.

- Start with the most important customer source systems, such as PAS, CRM, and ERP, which will stitch policies to policyholder/customer data.

- Identify the critical customer data elements. What data elements are most important to identify upsell and cross sell opportunities?

- Connect policy and customer data across systems to create a unified view of a customer to identify policyholder and household relationships.

- Send the data to a consuming analytical/reporting platform for marketing purposes. Start simple with batch processing and work toward real time. Again, the key here is to get the foundation built quickly to gain business benefit and add phases.

Now that the foundation is built, start planning the next phase to determine which use cases will provide the biggest business benefit by adding LOBs or new source systems.

- Update the source systems to improve customer service and have a shared view of a customer across LOBs and systems.

- Determine if real time processing will provide additional benefits.

- Expand to other domains (i.e. Product, Location) to get a full picture of the customer, their products, and where they’re located.

Interested in learning more best proven insurance strategies? Check out “What Can An Insurance Company Do To Drive Customer Experience and Insights?”

About Infoverity

For more information on Infoverity solutions, contact us today.